Investors, Owners + Operators

We lead our clients to redefine strategy and operations to respond effectively to unprecedented change.

Transforming business models to improve performance

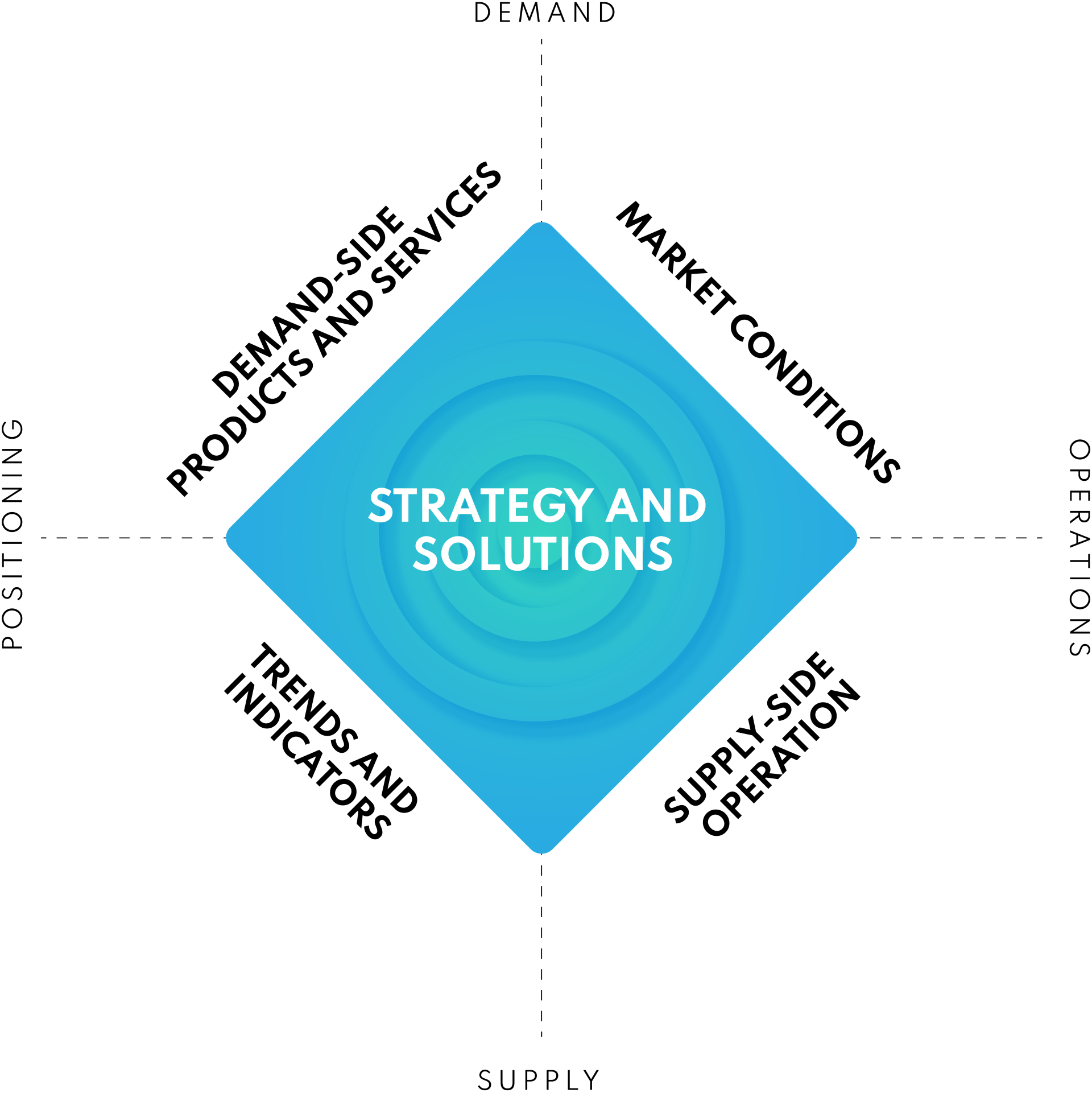

Trends and Indicators

Develop proprietary customer intelligence, fed by Adaptiv’s Enterprise Practice. that informs asset (re)positioning and ensure tight market alignment.

Demand-side

Develop expanded products and services that align with demand-profiles and analytics.

Market conditions

Develop a strong brand through differentiated levers that further strengthens value propositions for existing and prospective customers.

Supply-side

Rebake operations, marketing and sales models to ensure seamless alignment across expanded products and service offerings.

Core Objectives

Adaptiv creates long-term NOI and asset value. We measure and track impacts in these key areas:

Investment Thesis, Productization and Underwriting

Alternative Proforma vs. Traditional

Activation Premiums (on exit)

Operations

NOI (and other yield metrics)

Conversion Metrics

Retention Metrics

A proven approach to client value creation

EXPERIENCE