The Evolution of Buy-side Commercial Real Estate Intermediaries: From Space Brokers to Strategic Partners

The rise of technology-enabled "work-from-anywhere" is fundamentally reshaping commercial real estate, compelling buy-side intermediaries to transform their value proposition radically. While finding space, negotiating leases, and managing transactions remain important, these traditional services no longer suffice in an era where organizations are reimagining the very nature of work itself.

The Traditional Model's Misalignment

Historically, commercial real estate intermediaries built their success on market knowledge and transaction management, measuring achievement through square footage leased and deals closed. However, this transaction-centric approach has become increasingly obsolete as companies embrace hybrid work models and optimize their office footprints.

A fundamental misalignment exists in the traditional model: intermediaries earn higher commissions by securing larger spaces with longer lease terms—often in direct opposition to their client's evolving needs. This compensation structure, while historically profitable, has become anachronistic in today's dynamic business environment. Though clients ultimately finance this model through rent-embedded fees paid to building owners, the system primarily serves property owners' interests rather than tenants' operational objectives.

The Strategic Partnership Evolution

Forward-thinking real estate intermediaries are now repositioning themselves as strategic advisors, offering sophisticated services aligned with modern organizational needs:

- Strategic Advisory Services Modern intermediaries help organizations develop comprehensive workplace strategies encompassing portfolio optimization, location strategy in a hybrid world, and sustainability planning. The focus has shifted from pure transactions to driving transformational business outcomes.

- Data-Driven Intelligence Leading firms leverage advanced analytics to provide insights into occupancy patterns, employee behavior, and space utilization. This empirical approach enables predictive modeling and ROI analysis, facilitating informed real estate investment decisions.

- Experience Design As workplace environments now compete with home offices, intermediaries increasingly focus on employee experience design. This includes technology integration, collaborative space programming, and change management support to enhance productivity and engagement.

- Financial Innovation The market demands greater flexibility in real estate commitments. Progressive intermediaries are developing innovative lease structures, space-as-a-service models, and sophisticated cost allocation methodologies aligned with hybrid work patterns.

Technology Integration Modern workplace solutions must seamlessly blend physical and digital environments. Leading intermediaries advise on collaboration tools, space booking systems, and smart building technologies that enable effective hybrid work.

Continuous Partnership Model Perhaps the most significant evolution is the shift from transactional relationships to ongoing partnerships. Modern intermediaries provide regular strategy reviews, performance monitoring, and continuous improvement programs. This evolution drives changes in the traditional compensation models employed by intermediaries as commissions likely shrink, but value creation opportunities emerge and expand.

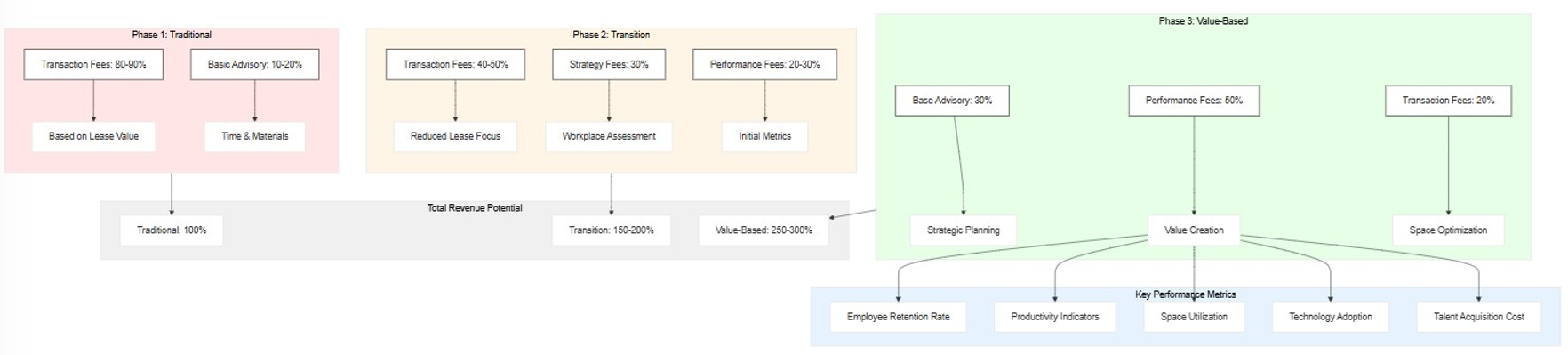

Revenue Model Evolution:

While these changes may appear dramatic in terms of commission restructuring, they represent a natural evolution toward a more sustainable and value-aligned business model. The shift from predominantly transaction-based fees to a more balanced mix of advisory, performance, and transaction fees enables more stable, predictable revenue streams while incentivizing innovation and greater value delivery to clients.

Building the Future

Success in this transformed landscape requires a fundamental reimagining of the intermediary role. Tomorrow's industry leaders will:

- Lead with strategic insight into clients' operational objectives rather than focusing solely on real estate transactions

- Seamlessly integrate multiple service lines into cohesive solutions

- Make substantial investments in technology and analytics capabilities

- Develop robust consulting practices

- Create sustainable, recurring revenue streams

- Focus on measurable business outcomes aligned with client goals

This transformation demands new skill sets, innovative pricing models, and significant technology investments. However, for those willing to evolve, the opportunity is compelling: to transition from transaction facilitator to indispensable strategic partner.

The future of commercial real estate intermediaries lies not in obsolescence but in delivering value far beyond traditional transactions. Those who successfully navigate this evolution will thrive in the new world of work, becoming essential partners in their clients' business success.