Re-Engineering for an alternative future for office investment and operation

For many investors and their capital partners, Covid 19 sped up behavioral change in how companies and their employees are working differently, altering their fundamental need for office space, and consequentially gutting the equity in their office investments. Asset after asset is in the news daily setting new price-per-square-foot lows that are unprecedented.

Many veterans in this business space hold out hope that the markets are just in a deep trough that will rebound—like in all cycles—back to a normal state at some point down the road.

Sadly, for those waiting for a return to normal, IMHO it just won’t happen. And this is why:

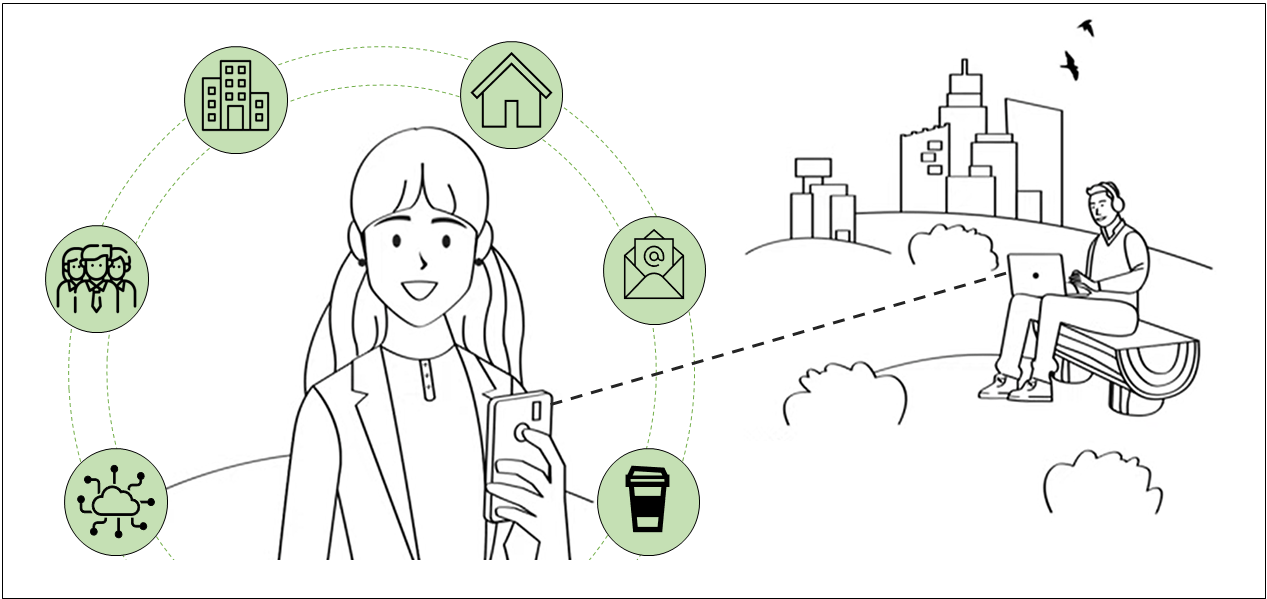

On the left is what “going to work” looked like for most of the last 100 years. It was primarily about place. After all, this is where your coworkers were, and where you interacted with company data and information. On the right-side future, going to work is fully realized around behavior and technology supported by place. In other words, the primacy of place in implementing work has been structurally disintermediated.

“Going to work” may become a quaint concept remembered in the future as something someone used to say walking out the door every morning. While it’s simple to conceptually understand what is taking place, if you are in the real estate business it’s deeply complicated to figure out the pivots you or your organization needs to make.

About 10 years ago, a couple of McKinsey consultants published research about the process of business model innovation across different vertical industries, which is routinely driven by new-entry players rather than existing sector market leaders. They postulated as to how innovation might be driven from within an industry, by an established player able to read the tea leaves and then adapt.

Their research encouraged company leaders to revisit fundamentals that never get discussed. Fundamentals so ingrained they do not warrant agenda time during strategy offsites and certainly never enter routine operational conversations.

Revisiting these fundamentals by commercial real estate industry professionals is no different than for any other vertical industry and the exercise begins as follows:

- Identify the attributes of the current dominant business model.

- Dissect the long-held beliefs (truths) common to the business operators.

- Turn the underlying beliefs on their head (brainstorm new, maybe even crazy ideas).

- Sanity test the business model reframe (ID relevant analogies sourced from other industries).

- Translate the reframe into a new business model for the business space you are in.

Applying this model to Commercial Real Estate office investment and operation

We’ve been using this diagnostic model with our clients for several years now and found definite consistency of results among different leadership teams which, as counterintuitive as this is for many office asset investors in the US markets, the findings paint a picture of a decidedly different future state of operation.

Here is a synthesis of where we believe the industry is headed and the issues that need to be addressed.

1. Identify the attributes of the dominant business model.

- Core customers are the capital markets, and other investors—never the actual end-user of the product (the tenant).

- Create cash flows / bond yields for >5 years only that can be forecasted.

- Apply a multiple (cap rate) to the portfolio of bond yields to establish value for trade, refi, etc.

- Very low lease churns a priority.

- Transactions with tenants are nearly always bespoke, and process, capital, and time intensive.

- Very high cost-of-goods-sold (COGS) to put leases in place.

- Capital / process intensive on tenant turnover / churn.

- Ownership objectives are in fundamental opposition to goals of end-user (sell the biggest possible space, for longest term lockup).

- Provision only basic life support services to the tenant (HVAC, water, electricity, and security).

2. Dissect the long-held beliefs.

- We are in the space business.

- Real estate is about location, location, and location.

- All we must compete with is other buildings nearby.

- Our relationship with our tenants is strictly transactional.

- Tenants are comfortable making long-term commitments.

- Tenants only want custom-built spaces.

- User experience is unimportant.

- The leasing process isn’t broken; it’s always worked that way.

- Churn is our enemy.

3. Turn underlying belief around.

- What if we were in the “satisfying our tenants’ business objectives” business? (wouldn’t we help them go smaller, for shorter periods of time?).

- What if our competition is new ways of working, and not just other buildings?

- What if our tenants don’t want to commit for longer than 5 years anymore? (tenants’ planning cycles are shortening to 2 to 3 years!)

- What if we focused on creating NOI, and profit rather than just rent? (how do we finance that?)

- What if user experience was valued by our tenants? (is this a point of differentiation?)

What if we shifted away from custom builds for our tenants? (does plug-and-play make sense for larger uses?)- What if we streamlined the space acquisition process? (using AI, pre-builds, standard documentation, etc. etc.)

- What if we created a value-add relationship with our tenants? (can we make a difference for them that is material to their operating goals?)

- What if we harnessed high churn to create value and NOI? (price mobility maybe not a bad thing given our big leases are locked in at the bottom of the market)

4. Sanity test the reframe.

- Multi-family averages 1-year contracts, with low capital intensity on churn.

- Hospitality averages less than 70% occupancy year-round but makes money.

- Hospitality has great customer loyalty derived from experience and loyalty programs.

- Hospitality makes money from services other than “rent”.

- MF and hospitality both value investments using trailing metrics freeing them up to innovate.

5. Translate the reframe into the industry’s new business model.

- Adapt to the changing needs of the end-user more effectively than competitors. This requires a capital stack aligned with deploying products and services whose NOI attributes may not be congruent with investor / lenders / and the overall capital markets’ traditional parameters for value creation.

- Deemphasize the importance of developing “bond yields” in favor of cash flow and NOI and repeatable profit over yield lock-in.

- Employ backward-value trailing multiples on NOI (both rent and services) or miss a huge part of the growing market for shorter duration products.

- Deploy more pre-built inventory and shift away from predominantly custom / bespoke space from the “studs up”.

- Embrace higher churn and frequency of contract turnover in investment underwriting and operations.

- Lower the capital intensity historically going into tenant turnover significantly increasing space and materiel repurposing.

- Densify the asset (more tenants per square foot) to improve “plant utilization” and ultimately asset capacity potential.

- Up the asset’s value proposition to end-users, help companies take less space, for shorter amounts of time to improve their utilization and reduce their financial leakage.

Conclusions

There is an old saying, “if it was easy, everyone would do it”. What the exercise above shows is how a company (or real estate investor/operator) might visualize operating into a changed future; unfortunately, it also reinforces why industry innovations are introduced more often by new players who don’t have legacy platforms to reengineer.

Making these changes will be hard to do, even for the most willing and enthusiastic players. Many of my friends in the commercial real estate office sector have already shifted their focus to other asset classes experiencing less disruption. It’s a lot easier to do that!

I personally believe that real estate office investors who remain stubbornly focused on perpetuating the legacy model of strictly leasing custom space for the long-term are in a flat-to-declining market with low growth prospects.

Those who retool, adapt, and develop deep expertise into how work is changing, and develop fluid investment and operating strategies to support their end-user customer companies in their own journeys will be well positioned to outperform for the long term—no matter how this sector continues to change and evolve.