Designing for the Future with

Office Owners, Operators and Investors

Differentiated, lasting asset- and portfolio-value necessary to excel in the face of a rapidly evolving commercial real estate marketplace

The US has likely reached "Peak Office" across its top 25 MSAs for the first time in 100 years. Business as usual is unlikely to return; performing well with this asset type requires a hard reset

OVERVIEW

Adaptiv readies office asset and portfolio owners to perform in the face of unprecedented change

Adaptiv works with some of the top private and institutional owners, operators, and investors across the U.S. and offshore on performance improvement.

In the coming years, as companies from all types of vertical industries sort out their preferred approach to physical workspace, owners may find themselves scrambling to fill emptying spaces as they compete with non-traditional occupancy options such as working-from-home (WFH), other types of remote work (coworking, informal 3rd place, structured 3rd place, etc.) and, at the very least, face a flat-to-declining office space market for the first time in memory.

As a thought leader in the evolution of workplace, Adaptiv helps clients redevelop and reshape how they think about, invest in and position their commercial real estate investments for successful performance.

The office owner's operating environment is dramatically changing

are you ready to attract the company whose employees can choose hoW, when AND WHere they want to work?

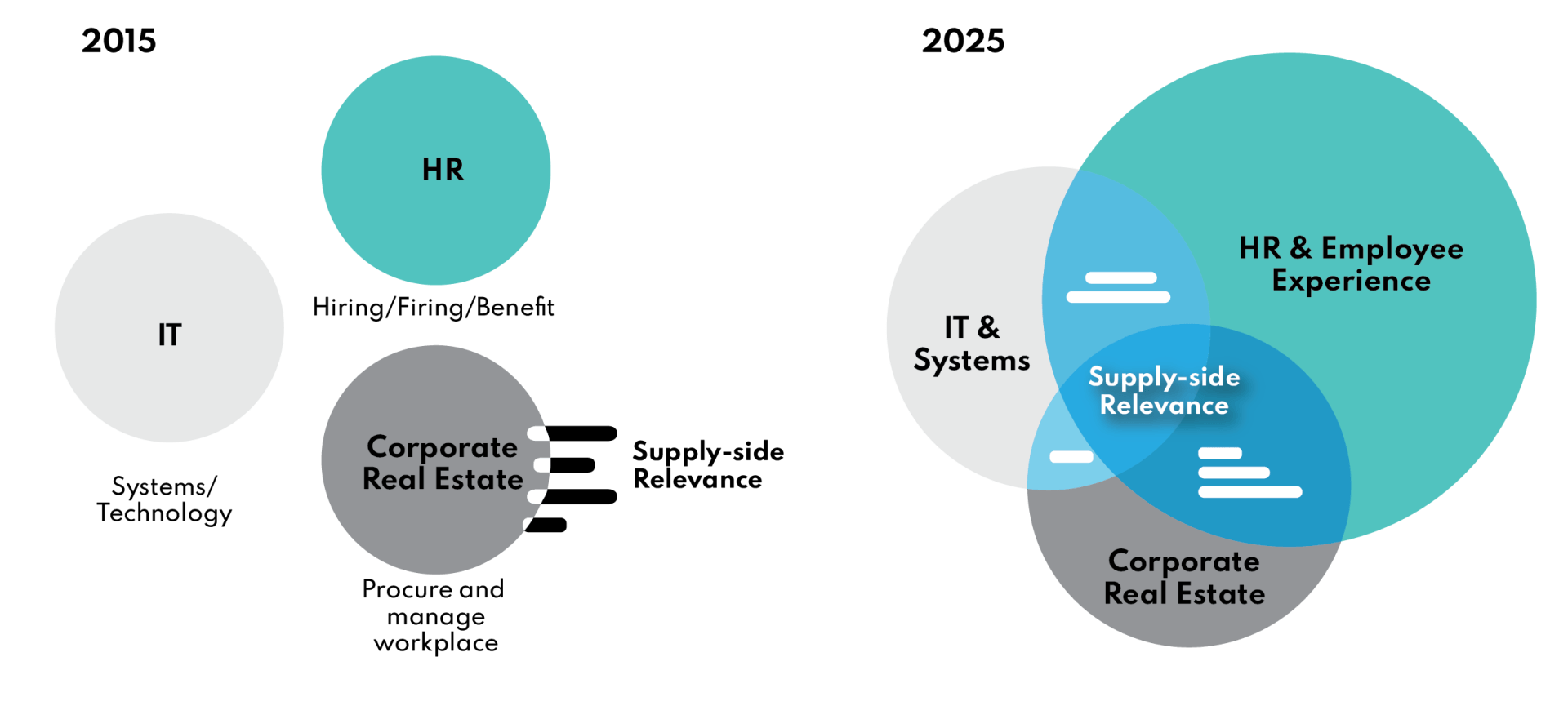

The relationship between owner and tenant has been largely transactional, but a company's need to support evolving employee optionality requires owners to forge greater collaboration

The gap has never been larger between the objectives of owners and tenants

Owners, capital, and lenders want locked-in, predictable "bond yield" lease commitments for a material period of time to which they can apply a cap rate. Further, they want to secure this commitment from a "credit tenant" who is happy to deploy additional capital resources guaranteeing this cash flow back to ownership no matter what.

That was fine when "work" and "office space" were synonymous with each other but that genie is permanently out of the bottle. Companies have new priorities around corporate agility and empowering employee choice that are driving a need for office owners to evolve their asset / portfolio positioning, operations, and overall investment theses. Doing so can unlock new value. Failing to do so risks material erosion and under-performance.

The supply-side, seeking only a "sell custom-fit space" relationship with the end-user, needs improved understanding of how to evolve their offering and better align with changing end-user objectives

Pioneering best-in-class solutions to shape the future of your portfolio

We empower asset ownership with a next-generation investment, asset management and operations framework enabling better alignment with the changing needs of the end-users, and to perform well even as work trends continue to evolve